Our mission is to give members peace of mind through better health, and providing access to affordable, quality health care is just the beginning.

We have a duty to look at every decision through the lens of financial responsibility because we know: every dollar we use comes from you.

Being open about how we use your money is our responsibility.

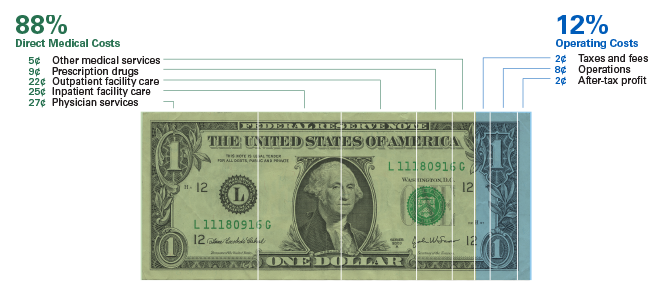

For every dollar we receive in premiums, we pay 88 cents for medical care.

Of the remaining 12 cents:

- 2 cents go to pay taxes and fees

- 2 cents are net income

- 8 cents cover operating costs

We paid $450 million in taxes that support programs and services benefitting Tennesseans, and we earned $495 million in after-tax net income.

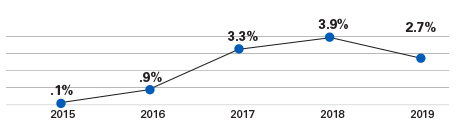

Our net income represents 2.7% of our gross revenues.

Our 5-year average for net income is 2.3%.

Reserves keep us financially stable

As a not-for-profit company, we don’t have shareholders or private owners who benefit from our business operations, so our net income goes into our reserve fund. This allows us to:

- Remain fiscally responsible

- Pay member claims and

- Lower our profit margins

We go above what’s required, so you have peace of mind.

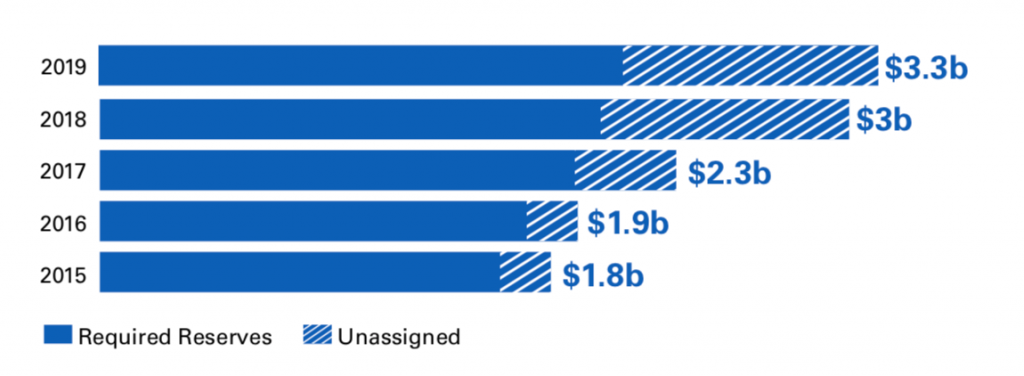

Safety nets aren’t just a way to give our employees and members peace of mind — we’re required by the state of Tennessee to maintain a certain level of reserves based on how many members we have, and how much we have to charge in premiums.

That requirement provides a safety net for members by ensuring we can pay all our claims and sustain operations in case of a disaster, epidemic or market downturn.

Our required reserves would only cover member claims for 62 days. We have $317 per member in total reserves, which would cover an additional 30 days of claims.

Our reserves – built over nearly 75 years – now total $3.3 billion, but $2.2 billion of those are required by law based on how many members we have and how much we have to charge in premiums. Those reserves are as important as ever as we face the COVID-19 pandemic together.

Paying claims quickly

As an insurer, our top priority is member health, and that starts with paying our share of your claims.

We provide health plans for 11,000 Tennessee employers and partner with 29,000 providers to make that process as cost-effective and simple as possible.

- We pay more than 56 million claims per year on behalf of members

- Our claims payments total around $16 billion each year

- 84% of claims are processed within 1 day

Want to learn more about claims?